SES weeks away from ordering six C-band satellites

SES weeks away from ordering six C-band satellites

WASHINGTON — SES is two to three weeks away from ordering six C-band satellites to replace older satellites whose usefulness will be cut short by the FCC’s upcoming spectrum auction, SES CEO Steve Collar told SpaceNews.

Collar said SES needs to get all six into production soon so the company will have the right satellites in orbit in 2023 to make due with the 200-megahertz slice of U.S. C-band spectrum satellite operators will have left after relinquishing 300 megahertz for cellular 5G networks.

SES intends to divide the six-satelite order among multiple manufacturers.

“The most important thing in this plan is speed and time, and no risk,” Collar said. “Part of that will be using diverse vendors both on the satellite side and on the launch vehicle side, with the priority being time to market.”

Collar declined to say which manufacturers are in the running to build the satellites. However, he said the orders will “be a good thing for the U.S. space industry,” which is home to established geostationary satellite manufacturers Boeing, Lockheed Martin, Maxar Technologies and Northrop Grumman.

Contract announcements for the six satellites might be staggered over the weeks ahead rather than made all at once, he said.

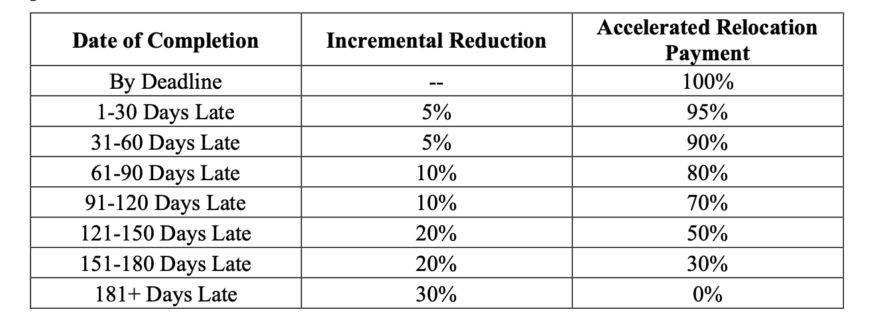

SES told the FCC late last month it will participate in the agency’s accelerated clearing program, which incentivizes satellite operators to clear 300 megahertz of North American C-band spectrum up to two years earlier than the December 2025 deadline. SES stands to receive a $3.97 billion incentive payment if it can vacate the repurposed band by Dec. 5, 2023. Missing that deadline by a single day would cost SES nearly $200 million in forfeited payment. The incentive would further shrink every 30 days, eventually reaching zero in June 2024.

The FCC’s accelerated clearing program calls for SES and the other participating satellite operators — Intelsat, Eutelsat, Telesat and Embratel Star One — to clear the first 120 megahertz by Dec. 5, 2021, a date Collar said is too soon to have replacement satellites in orbit. As an immediate step, SES is ordering signal filters for C-band customer antennas to prevent the disruption of television broadcasts and other services by upcoming cellular 5G signals. Collar said the replacement satellites will be required for SES to continue serving its C-band customers once the available bandwidth narrows further to 200 megahertz, down from the 500 megahertz of U.S. C-band currently allocated for satellite operators.

The FCC is requiring cellular network operators that bid for C-band spectrum in the agency’s Dec. 8 auction to reimburse satellite operators moving out of the spectrum for the cost of replacement satellites and other infrastructure. SES estimates it will spend $1.6 billion on replacement satellites, launches and ground equipment to clear its portion of the spectrum.

SES’s satellite orders will provide a boost to a satellite manufacturing sector in a year that has been light on orders. Only two manufacturers have announced commercial GEO satellite orders this year. Thales Alenia Space won Hispasat’s Amazonas Nexus satellite order in January and Maxar announced in May that it received a multiple-satellites order from a customer it declined to name. Analysts said last month that Maxar’s order is likely for C-band replacement satellites which, given SES’s upcoming procurement plans, appear to be for Intelsat.

Intelsat, which filed last month for Chapter 11 bankruptcy to protect its assets from creditors as it reorders its financial affairs, has said it will need up to seven C-band satellites to continue service with less spectrum.

Comments

Post a Comment