SAR Renaissance: Pandemic slows but doesn’t stop constellation progress

SAR Renaissance: Pandemic slows but doesn’t stop constellation progress

Startups around the world continue building synthetic aperture radar (SAR) satellites even as the COVID-19 pandemic delays some launches.

Since Finland’s Iceye proved in early 2018 that a small satellite can gather radar data and imagery, SAR startups have raised hundreds of millions of dollars for constellations. San-Francisco-based Capella Space, Iceye, Japan’s iQPS, PredaSAR of Boca Raton, Florida, Japan’s Synspective and Umbra Lab of Santa Barbara, California, have different business models and target audiences but all anticipate growing demand for SAR data.

“We’re heading into a SAR renaissance,” said Mark Matossian, CEO of Iceye U.S., an Iceye subsidiary. “What we are doing here is exciting and the competition will drive us all to better performance.”

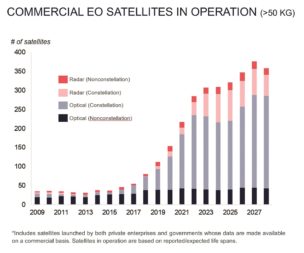

To date, defense and intelligence agencies around the world have been the primary consumers of SAR imagery and data. Companies like Synspective and Umbra Lab are betting on robust commercial demand in the not-toodistant future.

Synspective plans to become a onestop shop for geospatial data solutions with its planned constellation of about 30 satellites. “We are trying to extend the SAR market from government use to industry,” said Motoyuki Arai, Synspective founder and CEO.

“We are focusing on infrastructure development, disaster response and relevant financial sectors.”

Unlike many of its competitors, Umbra Lab plans to sell SAR imagery without offering geospatial analytics. “We are a bent pipe,” said Gabe Dominocielo, Umbra Lab co-founder. “We are a data provider.”

Umbra Lab expects the market for SAR to expand in response to its plan to offer inexpensive imagery with a resolution of 25 centimeters by 25 centimeters per pixel.

“As more sensors are launched and prices come down, we’re going to see the commercial market expand,” Dominocielo said.

Payam Banazadeh, Capella Space founder and CEO, said it remains to be seen exactly how higher resolution, frequent revisit opportunities and lower-cost imagery will affect demand. “The problem is we don’t fully understand the elasticity of the SAR market,” he said.

Capella launched Sequoia, its first operational SAR satellite, Aug. 30 on a Rocket Lab Electron. The company plans to establish a constellation of 36 satellites to obtain imagery with a resolution of 50 centimeters updated within an hour.

“We will take the next few weeks to go through commissioning and calibration,” Capella tweeted Aug. 31.

LAUNCH DELAYS

In January, Capella anticipated launching a total of seven satellites in 2020. The company no longer publicizes launch plans months ahead of time since the pandemic slowed down flights. Three- to six-month launch delays have become the norm, Banazadeh said.

Synspective, another firm that has faced launch delays, is preparing to launch its first SAR technology demonstration satellite, the approximately 150-kilogram StriX-a, on a Rocket Lab Electron from New Zealand in late 2020. The Japanese company plans to launch a second demonstration satellite in 2021 before beginning to develop its production model.

Iceye, which currently operates a constellation of three 100-kilogram SAR satellites and a dedicated mission for an unnamed customer is scheduled to launch four more satellites by year’s end.

“Our capacity will continue to grow significantly due to the combination of additional spacecraft, design improvements and spacecraft operational efficiency advancements,” Matossian said. “We don’t intend to slow down next year on launches or technology development.”

In recent months, Iceye began offering customers access to imagery with a resolution of 25 centimeters, which it acquires from a single satellite staring at a location for 10 seconds. The company also has demonstrated interferometric imaging as well as a product nicknamed SAR video that includes multiple images of a single location captured in a single satellite pass.

IQPS, part of Japan’s QPS Research Institute, launched its first 100-kilogram SAR satellite last November on an Indian Polar Satellite Launch Vehicle. The firm’s second satellite, QPS-SAR 2, is booked on Spaceflight’s SXRS-3 rideshare mission launching with SpaceX as soon as December.

By 2025, iQPS Inc. plans to operate 36 SAR satellites to “observe almost any point in the world in approximately 10 minutes and conduct fixed-point observations of particular areas once every 10 minutes,” the company said in a July news release.

PredaSAR, founded in 2019, plans to launch its first satellite in 2021 on a SpaceX rideshare mission.

The firm plans to operate an initial constellation of 48 SAR satellites, which it will expand “to provide as close as possible to persistent coverage over areas of interest,” said Marc Bell, PredaSAR co-founder and chairman.

PredaSAR’s constellation size will be dictated by the needs of government and industry customers, Bell said.

BEWARE OF CLIFFS

The latest SAR satellites are a fraction of the size and cost of previous generations of radar satellites built for government customers. Still, it’s a capital-intensive business.

Synspective, founded in 2017, reached $100 million in total funding in 2019. Capella Space, established in 2016, has raised more than $80 million. Iceye has raised about $65 million since forming in 2014.

IQPS, founded in 2005, has raised nearly $28 million according to CrunchBase, a website that tracks investment. The firm did not respond to interview requests.

PredaSAR, established in 2019, announced a $25 million seed funding round in March. Umbra Lab does not release information on its finances or launch plans.

In addition to delaying some launches, the pandemic has taken its toll on fundraising.

Companies building SAR satellite constellations need to raise significant capital before they begin earning revenue. Early in the pandemic, investment activity slowed dramatically. While the situation has improved somewhat, investors still may be hesitant to make “big bets on complex businesses like SAR,” Banazadeh said.

A lot of SAR companies that raised money before the pandemic need additional investment to launch their constellations.

“That’s the valley of death,” Banazadeh said. “We will see more companies than we typically do fall off a cliff there.”

Comments

Post a Comment