Companies are flying old satellites longer, study finds

Companies are flying old satellites longer, study finds

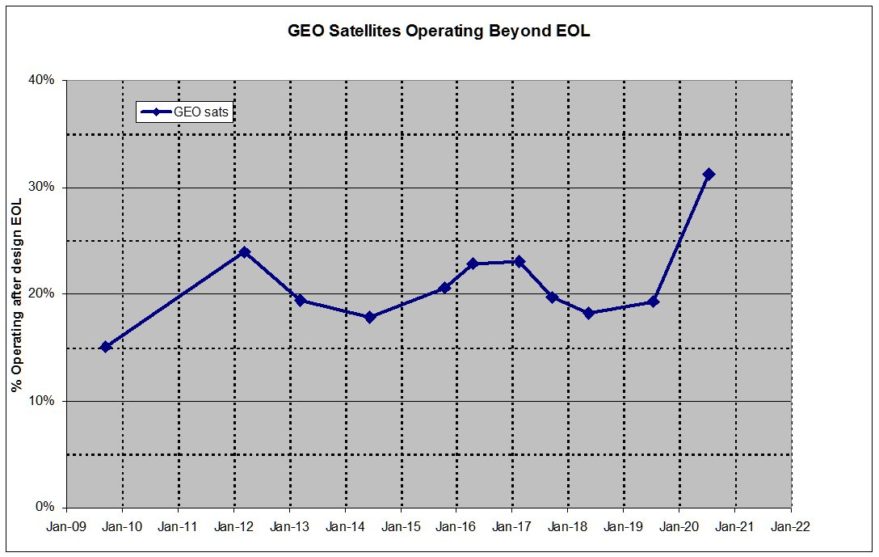

WASHINGTON — Nearly a third of commercial geostationary communications satellites in orbit are operating beyond their design lives, a far higher figure than in previous years, according to a study.

Research firm TelAstra of Los Angeles found that in 2020, some 31% of commercial geostationary comsats remained in service past their expected retirement, more than double the number of satellites putting in extra time in 2009.

Roger Rusch, president of TelAstra, said satellite operators appear to be maintaining older fleets for two primary reasons. The most immediate is that operators have ordered fewer satellites in recent years, leaving them with no other choice but to keep using aging satellites or diminish their coverage.

The other is that operators, when they do order satellites, are buying more powerful models that can do the job of multiple earlier spacecraft.

“The satellites being built today are much higher capacity, so it’s a more complicated equation than just looking at numbers of satellites,” Rusch told SpaceNews.

Geostationary satellites are typically designed for 15-year design lives, though that figure can vary. Rusch said there are approximately 350 commercial comsats in geostationary orbit.

Keeping aging satellites in service is likely to become a trend, Rusch said, particularly as operators buy more electric propulsion satellites that need less fuel to stay in orbit than chemically-propelled models. Solar panels on aging satellites do gradually lose their efficiency, resulting in less power, but operators can shut off some payloads to maintain limited service, he said. Operators can also co-locate satellites with limited power to maintain coverage over the same area, he said.

Rusch cited Iridium as an example some operators may look to, since Iridium’s first-generation satellites were designed for seven-year missions but often lasted around 20 years. Iridium’s Gen-1 constellation operated in low Earth orbit, as does the company’s new Iridium NEXT constellation, but the lessons are transferable to geostationary orbit, he said.

“If that kind of very clever and intense planning were to go into geostationary satellites, you could probably push the useful life of these satellites out to 30 years on a routine basis,” Rusch said. “I think some of that will go on.”

A trend of flying older satellites could be troubling to manufacturers hoping for new orders, but is probably better news for them than satellite servicing companies, Rusch said. Satellite operators will eventually need new satellites, and in-orbit life extension is still in its early days.

Northrop Grumman launched the world’s first satellite servicer last October and docked it with the 19-year-old Intelsat-901 satellite in February, beginning a five-year life extension. Startup Astroscale is designing a satellite servicer through its acquisition of Effective Space, and European heavyweights Airbus and Thales Alenia Space have signaled interest in the servicing market.

Satellite operators ordered 15 commercially competed geostationary communications spacecraft last year — more than twice as many as were ordered in 2017 and 2018 combined. This year operators have so far ordered 14 such satellites, but most (12) are replacement satellite orders triggered by an upcoming U.S. spectrum auction. Intelsat and SES were both planning to reduce their fleet size over North America were it not for spectrum policy changes that motivated each to order six C-band satellites.

Comments

Post a Comment